Corporate Connection E-Magazine

Corporate Connection is our quarterly e-magazine that features information on our latest happenings and hottest services. If you want an insider look at what’s going on at Vizo Financial, Corporate Connection is a must-read! Check it out now!

2023 Board Election Update

Guess what time it is? It’s board election season again! Here’s a quick update on our 2023 board of directors election:

The petition for nominations for the Vizo Financial 2023 board election expired on April 17, 2023, with no new nominations being submitted. The nominating committee submitted three nominees to fill the three open seats on our board of directors.

According to our bylaws, the election of directors is by plurality vote, except where there is only one nominee for a vacant position. As this is the case this year, we will not need a formal voting process and the slate of candidates will simply be approved during the virtual Annual Meeting on June 21, 2023.

As a reminder, nominations are not allowed from the floor during the Annual Meeting, unless sufficient nominations have not been made to provide one nominee for each vacant position, or circumstances prevent the candidacy of a nominee for a vacant position.

Therefore, at this time, the three candidates who will be confirmed as directors during our Annual Meeting are as follows:

- Genice DeCorte (incumbent), CEO, HealthShare Credit Union, Greensboro, N.C.

- Mark Volponi (incumbent), president & CEO, USX Federal Credit Union, Cranberry Township, Pa.

- R. Scott Weaver (incumbent), CEO, Carolina Foothills Federal Credit Union, Spartanburg, S.C.

We’ve also launched our Annual Meeting website, which is your go-to place for more information regarding the 2023 board election, biographies of the candidates, important dates to remember and more.

On that note, make sure to attend our Annual Meeting in June to get the official election results and join in on other important discussions. See the Upcoming Events article below for more details. And, as always, thank you all for your continued support of Vizo Financial!

We’re Celebrating a DECADE OF DOGS!

By Staci Wright, fraud risk analyst, and Brittany Hockenberry, communications specialist, Vizo Financial

What does a hot dog mean to you? This might sound like a silly question, but let us paint a picture beyond the bun, the condiments, the toppings and the deliciousness. For the past decade, hot dogs have been bringing in thousands of dollars for the care and treatment of sick and injured children at Penn State Health Children’s Hospital in Hershey, Pa., one of 170 Children’s Miracle Network (CMN) Hospitals in the U.S.

That’s because, at Vizo Financial, we’ve been holding our annual Hot Dog Eating Contest to raise money and awareness for CMN Hospitals for the past 10 years. In 2023, we’re thrilled – no, elated – to be celebrating our official DECADE OF DOGS on July 19, 2023!

What has a DECADE OF DOGS looked like?

Our inaugural event in 2014 took place on the blacktop of our Middletown campus with five contestants and a handful of supporters cheering them on. The event raised $1,150 for CMN Hospitals, and it was…well…a total success!

Since then, though, it has grown in every way year after year. The once in-person contest is now held virtually, giving all credit unions across the country the chance to participate in one way or another. We’ve seen five contestants turn into nine, seven sponsors turn into 29, that $1,150 total from the 2014 contest exceed a collective grand total of $46,000 and several Miracle Children and their families tell the stories of what this contest, and other fundraisers like it, do to ensure their care at CMN Hospitals.

Check out this video to see for yourself the fun and the memories that we’ve experienced over the past 10 years of Vizo Financial’s Hot Dog Eating contests:

Time to celebrate!

For our 10th anniversary – the aluminum anniversary, to be exact – we’re pulling out all the stops to celebrate. We’re talking more sponsorship opportunities, more prizes, more hype! And the best part is that we want you to be a part of all of it!

Sponsorships

We’ll have our tried-and-true sponsorships – Frankfurter and All the Fixin’s – available this year, as well as a special DECADE OF DOGS sponsorship. Here’s more on each sponsorship level:

|

Frankfurter - $50

|

|

All the Fixin’s - $100

|

|

DECADE OF DOGS - $200

|

Contestants

As always, we’re inviting any credit union employee to get hands-on and join in as a contestant! Where else can you compete to raise money for kids, eat as many hot dogs as you please and win one of three prizes: The Top Dog, Hot Diggity Dog or Rollin’ in the Dough? At our 10th anniversary Hot Dog Eating Contest, of course!

CU Promo Kit

We want to spread the word far and wide about this year’s Hot Dog Eating Contest, so we’re giving all sponsoring credit unions the tools to help us do just that with a CU promo kit. The kit will include web banners, social media posts, email text, an infographic flyer and more. For credit unions that choose a DECADE OF DOGS sponsorship, we’ll also include an exclusive commercial to add to your social media profiles, website, branch TVs or wherever you’d like. Use all these materials to amp up the excitement throughout your credit union and with your members!

This contest is so much more than just a contest…

While the Hot Dog Eating Contest is always a good time, it’s so much more than just a Hot Dog Eating Contest. It’s about meeting one of the 925 babies CMN Hospitals treats in the NICU each day…like Joella. She was one of the Miracle Children we were lucky enough to have speak at our contest over the years. She was a CMN Hospitals patient from birth, and, thanks to money from fundraising campaigns like our annual Hot Dog Eating Contest, she is now a happy and energetic little girl.

That’s because CMN Hospitals offer so much more than life-saving medical care. They give children a chance to live their greatest lives, to overcome the odds and to become real-life miracles. This is why our contest is one of our greatest accomplishments each year – because it truly does give us and credit unions everywhere the chance to live out our “people helping people” philosophy and be part of the miracles at CMN Hospitals.

We could go on and on all day about just how much we love our Hot Dog Eating Contest and the excitement surrounding our big DECADE OF DOGS celebration! But, we’ll spare you…mostly! All we ask is that you consider joining in on our 10th anniversary and making this our biggest year yet for the kids and families of CMN Hospitals. In fact, we double dog dare you!

Save the date for July 19, and look for registration coming soon!

Focus Spotlight: An All-in-One Core & Community

What could be better than a core system and a community of core resources? It sounds like a dream, doesn’t it? Well, we’re here to tell you…it’s not.

With CUaxis – the common core community curated by Vizo Financial, MY CU Services and CU*Answers – it’s a reality.

A Core that Wins

While there is no perfect core, a 100 percent credit union-owned suite can be the perfect solution for your organization! Our core solution is just that, and it is helping transform how 350+ credit unions across the country are winning in their communities.

That’s because we do our best to stand out from the crowd. We’re swimming in a sea full of core processors – many of them giants in the financial industry – but what helps CUaxis and our core solution remain unique are these features:

- A cooperative model that drives credit unions to engage, participate and win together.

- A commitment to reduce fees with deals and discounts that no other organization offers.

- An uncommonly deep core with a suite of staff and member-facing tools at an aggressive price point.

- An internet retail store presence to help you drive new member growth through free mobile web products and member self-service tools.

- A passion to innovate with a do-it-together philosophy, and the resources to meet your specific needs.

- Data warehousing and analytics tools that deliver bottom-line results.

- Free APIs for simple, yet massive integration.

- Free releases and updates — no additional costs!

- A virtual, no-cost safety deposit box that is delivered securely to every member.

- Free ongoing education including networking events, focus groups, webinars and the like.

- Analytics booth for delivering critical data points.

- A talented team of industry and business development experts ready to work for your credit union.

- A one-stop delivery channel, which eliminates the need for many costly third-party vendor contracts.

A Community that Supports

Those are just the tip of the iceberg. There’s also the CUaxis All-Access Pass – your key to the kingdom of core resources, support and collaboration. The point is, our common core community is a place where credit union partnerships are fostered to give all institutions – regardless of asset size, field of membership, location, etc. – direct access to core processing (and additional) services, education, expertise and the backing of our movement’s cooperative principles, altogether in a one-stop shop, so to speak!

Ultimately, what you can count on is a vested network of partners with tightly integrated services and a common goal of helping credit unions, all at a fraction of the cost of “traditional” vendors. It’s an all-in-one core solution and community – what’s not to love?

Want to learn more about CUaxis and our core solution? Contact your corporate account manager at accountmanagers@vfccu.org, or go to www.cuaxis.org.

Did You Know: Student Loan Season is Coming!

Each year, spring is characterized by blooming flowers, warming temperatures and…oh, yeah…student loan season!

Soon, credit unions like yours will see the hustle and bustle of higher education-bound students gathering all their information, submitting their FAFSAs and shopping around for student loan options.

When that shopping comes to your credit union’s doors, know that there is a flexible and borrower-friendly option you can offer through Vizo Financial’s partnership with Sallie Mae: the Student Loan program. And get this – it’s also credit union-friendly in terms of time, resources and income! Here’s the complete benefits rundown:

Benefits to Your Credit Union

- Expands your credit union’s product line at no cost or funding.

- Offers high-value products that can attract and retain valuable members.

- Generates fee income per originated loan without any upfront investment from your credit union.

- Includes a resource portal with marketing materials so your credit union can easily promote the program.

Benefits to Your Members

- Makes money available that students need for college so they can borrow up to 100 percent for school-certified expenses like tuition, fees, books, housing, meals, travel and more.

- Let’s members choose from three simple repayment options that also offer a choice of competitive fixed or variable interest rates.

- Allows members to earn a 0.25 percentage point interest rate reduction when they enroll in and make monthly payments by auto debit.

- Has an easy and fast online application. Members can also manage their loans online, 24/7.

- Offers assistance to your members, when needed, through Sallie Mae’s dedicated customer service and technical assistance centers.

Already Offer the Sallie Mae Student Loan program?

Don’t forget about the amazing marketing materials available to you through the Sallie Mae marketing portal. They’re all pre-made resources, including print materials, web text, social media graphics, email templates and so on. All you have to do to access them is log into the partner portal, choose your preferred promotional materials, customize them with your credit union’s logo and be on your way.

Join Our Upcoming Sallie Mae webinar!

Looking for even more details on the Sallie Mae student program? You’re in luck! We’re hosting a Sallie Mae webinar on April 25, 2023, at 10:00 a.m. ET. Karie Bedford from Sallie Mae will be sharing information on how the program works, the pros for your credit union and the plethora of implementation and marketing resources. If you’re interested, register today and we’ll see you there.

Ready to spring into action before the student loan rush? Contact your corporate account manager at accountmanagers@vfccu.org!

PARTNER ARTICLE: Redefining Primary Relationships

By Mike Branton and Dave DeFazio, StrategyCorps

Ask 100 bankers to define what it means to be the primary financial institution for a consumer, and you’ll likely get 100 different answers. Ask 100 consultants to bankers what being the primary FI entails, and you’ll probably get 100 more answers.

Ask 100 consumers how they define which FI is their primary one, and you’re apt to get just a few answers. The most frequent answers will be: where my paycheck is deposited or what I use to pay my bills.

At StrategyCorps, we talk to a lot of bankers about being the primary FI for a customer or member. We call this primacy. We talk about what they’re doing to lock down primary relationships to keep from losing them and what’s being done with non-primary customers to win them over and make them financially productive.

With few exceptions, most community and regional banks do not have a quantitative measurement or definition of primacy. It’s still very much rooted in a banker’s intuition or past experience, rather than a data-driven approach to determine precisely which customers are primary and which aren’t.

The Math

In our 20+ years studying and analyzing retail checking relationships, products and pricing strategies, we have developed a database of well over one billion data performance points from hundreds of financial institutions.

We have found through this analytical approach a metric that holds true with nearly every FI we analyze, regardless of size or operating area location. Here it is: If the banking activity of a customer on a household basis isn’t generating annually at least $350 in revenue, that household doesn’t consider your organization their primary FI.

Like clockwork, we find that when household revenue is less than $350, the banking relationship effectively nosedives. This typically is the case for 35 percent of all consumer checking accounts. More specifically, we find this 35 percent of total checking account relationships represent slightly less than 2.1 percent of total relationship dollars and generate only 3.7 percent of revenue.

Address the Gap

Those customers are not engaged in a mutually beneficial relationship with their FI. They aren’t doing enough banking activities to generate enough revenue to cover the cost to manage and maintain their relationship. Many of those customers are primarily engaged at another FI and need a more compelling reason to bank with your FI than is currently being provided.

A major advantage of knowing specifically who does not consider your bank a primary FI is that you can develop product, pricing, communication and business development campaigns to move them closer to generating at least $350 in revenue. If you don’t, those 35 percent of relationships will continue to drag down financial performance. And this financial drag can be sizeable — conservatively speaking, about $204 a year per relationship.

Do the math: If you have 20,000 checking relationships, 7,000 will be non-primary with a deficit of $204 per relationship. This equates to an annual loss of $1.43 million.

Build Profitability

Another major advantage of knowing precisely the amount of primary relationships at your institution is that knowledge provides great insight for a game plan to lock the relationship down even further with enhanced product offers, preferred pricing, elevated levels of customer service or, in some cases, a thank you. Doing one or more of those things diminishes the chances they’ll consider an offer from a competitor.

In today’s ultra-competitive marketplace, smart bankers realize a data-based definition of primacy in their retail checking base is necessary to make timely decisions. Banks that do so can better protect and grow primary relationships, and fix and grow the non-primary ones. By doing both, they optimize the performance and growth of their retail checking base and don’t leave the financial performance of their checking accounts to guesswork.

Security Corner: When Social Engineering Meets Sherlock Holmes

By Mike Bechtel, information security analyst, Vizo Financial

‘Tis the season of social engineering…or is it?

Truth be told, social engineering perpetrated by bad actors never takes a holiday, which means there is no one season where it’s more prevalent than another. Social engineering and its puppet masters adapt to us and our changes in the same way we adapt to the weather. When it gets cold, we put on a jacket; when it’s tax season, social engineering will ask for your W2 information. It’s a master of disguise, which is where its effectiveness lies.

In the past few years, the world has seen social engineering take on a few of these seemingly ordinary, yet questionable forms: text messages from executive team members asking staff to call them back, emails from senior staff asking for a wire to be processed, emails from credit unions asking to verify account details, messages from the IRS asking for tax information, inquisitors asking for gift cards as a form of payment and pop-ups on websites alerting of viruses or malware.

During the pandemic (and this applies to any hard time, really), bad actors ramped up their activity to take advantage of widespread financial struggles to the tune of a 69 percent increase in cybercrimes between 2019 and 2020, according to the FBI’s Internet Crime Compliance Center. We’ve even heard reports of bad actors posing as repair technicians and carrying out their attacks in person, hiding in plain sight.

These are just a few scenarios that have befallen financial institutions. Remember that we’re a major target in the social engineering world because of our direct access to money and people’s sensitive financial data.

That’s the bad news.

The good news is that there’s an infamous literary sleuth (in a dashing hat, might I add) who just may hold the inspiration for your social engineering preparations. Yes, I’m talking about the whimsical, offbeat and ingenious Sherlock Holmes. Now if you’re wondering what in the world Sherlock Holmes has to do with social engineering, let me show you the reasoning behind the madness.

You see, most social engineering attempts can be thwarted by three simple strategies that Sherlock Holmes would certainly approve of:

Gather the facts before anything else. First things first, slow down and ask yourself a few questions. Context clues can go a long way in helping you solve the social engineering puzzle. Think back to your early education days and remember the five Ws and one H – who, what, when, where, why and how?

For example, if the CEO is texting you, let’s consider the WHO – who is it that you’re talking to? The texter says they are your CEO, but is it really? If you have a company-issued mobile phone and text with the CEO from time to time, all the legitimate messages from that person will all show up under the same text chain, never from a random number.

Now for the WHAT – what are they asking me to do? If there is something important enough for the CEO to reach out to you by text, they will probably not be asking you to call them back. They will call you directly or contact your supervisor.

How about the WHEN – when did this text message arrive? If the CEO sends you at text message from an unknown number at 2:00 p.m. on Tuesday, is that perhaps a little strange? There are so many more effective ways to get in touch with a staff member in the middle of a workday. In-office messaging, email and direct phone calls are just a few ways that would make more sense.

Next, determine the WHERE – where does the CEO want me to call them back? If they have a company-issued mobile phone, company-issued email, company-issued desk phone number, calling them back at an unknown number should indicate some red flags.

Then there is the WHY – why is the CEO reaching out to me? In a typical corporate environment, there is a hierarchy with the CEO at the top, then other executives, then directors, then middle management and so on. The further removed you are, the less likely the CEO would be to reach out to you directly, right? There is a reason for the chain of command in every department and throughout the company, so this scenario is somewhat suspicious.

Finally, we get to the HOW – how did the CEO get my number? If you have company-issued mobile phone and do not text with the CEO, or got a random text from them on your personal phone, ask yourself…how did they get my number? The CEO likely has other pressing matters to attend to rather than looking up your personal mobile number.

This process of questioning things is the same as looking for red flags in an email. If one red flag does not make a bad email, then the same can be said here. One good answer to one of these questions does not make a good situation. When these kinds of situations come up, do your best Sherlock impression and work through the questions to get a better sense of the safety of the situation.

Get your members involved. If your credit union is a target, so are your members. That means educating them on social engineering tactics and prevention is just as important as educating your staff. They, too, are participants in the bad actors’ twisted games, and they should know how to play.

How can you do that? For one, keep social engineering top of mind for members. Display messages on your website (and update them often so the idea isn’t static), send emails about recent scams and even host seminars about social engineering. Give members the opportunity to learn all that they can to protect themselves and your credit union from becoming victims.

However, if a member does fall victim at some point, kindly and gently enlist their help. Yes, they are going to be going through several emotions of anger, guilt, embarrassment, grief, etc., but they also have key insight that can help all parties learn from the situation and maybe even put new policies in place to, hopefully, avoid future losses.

Become a bad actor…for good! In other words, do a little undercover brain work and think like the people behind the social engineering attacks. Try to put yourself in their malicious mindset and go through their motions. They don’t just randomly pick a name and an institution to target – they study their prey like lions in the tall grass, so do the same to them.

This is another place where that first-hand experience from members who have been victims of social engineering attacks would be incredibly helpful, as they were an integral part of the bad actor’s process. In the end, these steps may provide some foresight into future attacks and actions you can take as a credit union to be a step or two ahead.

It might seem like a “curious” crossroads between social engineering and Sherlock Holmes, but often times, it’s the roundabout road that leads us to an exceptionally satisfying outcome. So, with these tactics in your social engineering arsenal, I invite you to put on your tweed deerstalker hat, pick up your spy glass and try your hand at being a sleuthing extraordinaire. The results may just be anything but “elementary.”

Community Involvement

Vizo Financial continues to make a positive difference in our local communities. Here’s what we’ve been doing over the past few months:

Turkish Cooperative Earthquake Relief Fund

Vizo Financial donated $20,000 to the Worldwide Foundation for Credit Unions’ Turkish Cooperative Earthquake Relief Fund. This fund was launched to support Turkey’s cooperative system during this incredibly difficult time following two devastating earthquakes in early February. According to a joint statement from WFCU and WOCCU, “Tarimkredi (Turkish Agricultural Credit Cooperatives) has more than 150 cooperatives with 80,000 members in the 10 provinces impacted by the earthquakes and estimates at least half of those institutions have suffered some level of destruction.” The fund is still accepting donations to help reach their $100,000 goal.

Financial Reality Fairs

Vizo Financial staff volunteered at a financial reality fair at Newport High School in Newport, Pa. The reality fair was hosted by Belco Community Credit Union. Financial reality fairs are an interactive financial education experience for students. This hands-on experience allows students to identify their career choice and starting salaries, then complete a budget sheet requiring them to live within their monthly salary while paying for basics such as housing, utilities, transportation, clothing and food. Additional expenditures such as entertainment and travel are factored in as well.

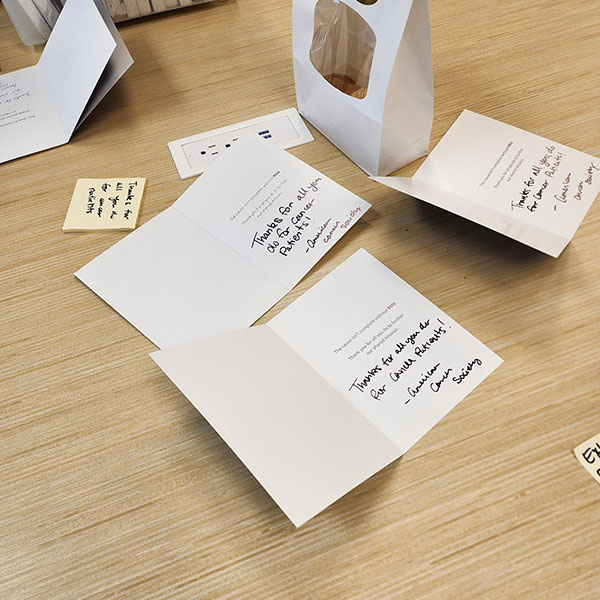

Daffodil Days for American Cancer Society

Vizo Financial employees at all of our campuses had the opportunity to purchase real or virtual daffodils in support of Daffodil Days for the American Cancer Society. Staff from the Pittsburgh campus volunteered and assisted in distributing daffodils, as well as writing thank you notes to the American Cancer Society’s local partners and donors.

Egg Stuffing for The Hershey Company’s Annual Egg Scramble

On March 24, several members of Vizo Financial staff volunteered to help stuff nearly 8,000 Easter eggs for The Hershey Company’s Annual Miracle Family & Friends Egg Scramble to benefit Children’s Miracle Network (CMN) Hospitals at Penn State Health Children’s Hospital. This year’s scramble marked the first time back fully in person since the pandemic.

50th Anniversary Credit Union Cherry Blossom Run

Vizo Financial was a sponsor for the 50th anniversary of the Credit Union Cherry Blossom 10 Mile and 5k Run on April 1-2 in Washington, D.C. We also proudly cheered on two of our own employees in the 10 Mile Run. This event was hosted by credit unions and benefitted CMN Hospitals.

Bears for Victory Junction

Over the past few years, the spouse of a Vizo Financial employee has been handmaking stuffed bears for campers at Victory Junction. Victory Junction is a medically safe, yet exhilarating, camp that challenges children who have a serious medical condition to try things they never imagined possible. Every camper gets their own Victory Junction bear to take home after their week at camp, and all of the bears are made by volunteers. The camp is located in Randleman, N.C., and Carolinas credit unions, including Vizo Financial, have been supporting its mission in a variety of ways since its inception.

Here’s what’s coming up:

Walk for Children's

Vizo Financial is once again sponsoring and participating in the Children’s Hospital of Pittsburgh Foundation’s Walk for Children’s event on June 3, 2023. Walk for Children’s is an annual family walk event that benefits Children’s Hospital of Pittsburgh of UPMC – a Children’s Miracle Network (CMN) Hospital – by bringing the community together and raising money for patient care. The event is being held in-person at Schenley Park in Pittsburgh, as well as virtually. Our staff looks forward to joining in the fun and raising money and awareness for this great cause!

10th Annual Hot Dog Eating Contest

Can you believe it’s been a DECADE OF DOGS? That’s right! Vizo Financial will be hosting our 10th annual Hot Dog Eating Contest for CMN Hospitals at Penn State Health Children’s Hospital in Hershey, Pa. The hospital is an organization dedicated to providing care and support to children and their families. Our donations and support help them continue serving children in need. The contest will once again be virtual, so we are welcoming credit unions across the country to join in the fun as contestants, sponsors and supporters of CMN Hospitals on July 19, 2023.

And since this is our milestone 10th anniversary, we’re taking the celebrations very seriously with more sponsorship opportunities, three grand prizes, t-shirts for purchase and a whole promotional kit to help get your members and community involved too. So, save the date and make plans to join us for this fun-filled event to help raise money and awareness for CMN Hospitals at Penn State Health Children's Hospital! WE DOUBLE DOG DARE YOU TO MAKE THIS OUR BIGGEST YEAR YET!

Registration will be ready soon…stay tuned!

Upcoming Events

Vizo Financial will be hosting the following events for credit unions. Please register for any of our events on the Upcoming Events page of our website.

Financial Strategies Workshop

April 26, 2023

DoubleTree by Hilton Pittsburgh Cranberry – Pittsburgh, Pa.

The last three years have held a pandemic, record inflation, a crisis in Ukraine and a rise in interest rates, so what does 2023 hold for the economy? That’s a question on a lot of people’s minds. While we can’t be certain what’s in store for 2023, we do know that planning, preparing and education are vital in helping us achieve our financial goals for the year. That’s why we’re inviting you to join us in Pittsburgh, Pa., for our final 2023 Financial Strategies Workshop!

This one-day workshop will offer expert-led sessions on asset liability management (ALM), investments, the economy and more, along with the opportunity to earn four (4) CPE credits and network with fellow credit union professionals. We hope to see you there!

Leadership Workshops

May 4, 2023 - Hershey, Pa.

May 11, 2023 - Richmond, Va.

May 25, 2023 - Charlotte, N.C.

June 1, 2023 - Pittsburgh, Pa.

During this workshop, participants will learn how to increase their value to members by uncovering sales opportunities. The approach taught is not an aggressive sales approach that may be seen as a turn-off to members and staff alike. Instead, this approach is built on knowing your member and making the appropriate suggestion of a product or service that will benefit the member. Many times, a credit union employee may recognize a product to offer a member but feel “pushy” making the suggestion.

Member Appreciation Reception

May 19, 2023 - The Hershey Lodge – Hershey, Pa.

We’re gathering in the SWEETEST place on earth to celebrate the SWEETEST members on earth — you all! We’re throwing a reception in your honor during the 2023 CrossState CU Association’s Reconnect Annual Convention. We invite you to join us on May 19 from 5:00 – 6:00 p.m. at The Hershey Lodge in Hershey, Pa. We’ll have tasty food, great conversations and, of course, loads of fun! We hope you’ll join us so we can show you just how appreciative we are of you and our partnership.

Member Appreciation Breakfast

June 13, 2023 - The Omni Grove Park Inn – Asheville, N.C.

Is there any better way to start the day than with a grateful heart and a full belly? We don’t think so! Our Member Appreciation Breakfast pledges to bring the best of both worlds to our wonderful credit unions on June 13, 2023. Let us shower you with all the gratitude and breakfast delicacies at this special gathering from 7:30 - 9:00 a.m. in the Seely Pavilion at the Omni Grove Park Inn in Asheville, N.C., during the Carolinas Credit Union League’s Annual Convention. We’re excited to see you there!

Annual Meeting

June 21, 2023 - Virtual

Member credit unions, you're invited! Our 2023 Annual Meeting is coming to a screen near you on June 21, 2023. This members-only event will be a virtual meeting where we can review the Corporate’s financials and discuss various executive/board reports. Vizo Financial would love for your credit union to participate in the virtual Annual Meeting, so register today and plan to attend from wherever you may be on June 21!

Second Quarter 2023 Education Sessions

Vizo Financial’s education sessions for the second quarter of 2023 are:

Offer Education Loans to Your Members with Sallie Mae

Karie Bedford, Sallie Mae

April 25 at 10:00 a.m. ET

Now is the time to start preparing for the rush of students – many of them your members – searching for education loans. As college tuition costs continue to rise, more students are in need of private education loans to help fund the gap between financial aid and college expenses. With the Education Loans from Sallie Mae, in partnership with Vizo Financial, your credit union members can choose from three in-school repayment options to help them pay off their loans faster and save more money compared to the conventional private loan.

But First We Verify – Proper Use of Micro-Entries and Prenotes

Jessica Lelii, director of education, Macha/PAR

May 2 at 2:00 p.m. ET

Does your institution know your rights and obligations regarding micro-entries and prenotifications? In this session, we will explore the proper initiation and handling of micro-entries and prenotes. Properly handling these items can help to reduce the number of future exception items and future headaches.

Adjusting Historical Data Under CECL – Qualitative Factors Run Amuck

Mike Umscheid, president/CEO, ARCSys

May 30 at 10:00 a.m. ET

This educational opportunity will feature Mike Umscheid, a seasoned expert who will discuss the purpose of quantitative and qualitative factors under the Current Expected Credit Loss (CECL) standard. This webinar will delve into the key differences between the Q-Factor methodologies of CECL and the Incurred Loss Model (ILM), and how these differences impact the selection, adjustment and documentation of historical data. The session will also provide insights into the CECL standard components that should be considered when adjusting historical data, as well as how to adjust third-party data to align with CECL requirements. Join us for an informative session with Mike Umscheid on CECL compliance and best practices.

Seeing Beyond the Regulatory Requirements of Security Awareness

Mike Bechtel, information security analyst, Vizo Financial

May 31 at 10:00 a.m. ET

Why do most credit unions perform security awareness training? It’s probably because it’s a requirement set forth by the NCUA. Say no more, right? Wrong. The importance of security awareness goes far beyond just a regulatory requirement – it’s a crucial knowledge base that every credit union staff and board member should have. With the constant deluge of cyber threats, fraud attempts and social engineering scams aimed at credit unions, we have a duty to protect our institutions and our members…and we can with the proper emphasis on security awareness training.

Protecting Your Members from Elder Financial Abuse

Cindy Hagan, compliance and fraud risk director, Vizo Financial

June 6 at 10:00 a.m. ET

They say age is just a number. But for scammers, age is an opportunity to prey upon a person's vulnerabilities. That's why older individuals are most at risk for financial exploitation, and it costs millions (yes, millions) of dollars per year in losses for these individuals. You may be wondering what your credit union can do to help your members fight back against elder financial abuse. That's what this session is all about! Cindy will walk you through common signs, schemes and suspects to help your staff and your members armor up against elder financial abuse.

ALM: The Captain of Credit Union Capital Controls

Michael Rice, senior ALM analyst, Vizo Financial

June 7 at 10:00 a.m. ET

Who is the chief in charge when it comes to balancing your credit union’s capital? Be careful before you answer because it’s not any single person. It’s a culmination of daily decisions at your credit union. Your ALM model helps you to navigate these decisions and find your true north when it comes to capital planning and developing your credit union’s budget and strategic plan. This session will cover how you can effectively manage and monitor your net worth by using the ALM model to guide your strategic planning, establish meaningful policy limits and acknowledge your risks.

Tabletop Exercise – Threats to Your Credit Union

Mark Clarke, business continuity administrator, Vizo Financial

June 8 at 10:00 a.m. ET

A tabletop exercise is a walk-through of emergency procedures with your credit union’s key personnel about what could happen in a real-life incident. This live tabletop webinar will test your credit union’s plans with a “mock” real-world example. How will your team handle the situation? Are you prepared?

Card Disputes Master Class

Kari Kronberg, AAP, NCP, director of education, Macha/PAR

June 20 at 10:00 a.m. ET

Card disputes can take on a life of their own. There are dates to remember, credits in and out, chargeback rights, regulations…How does anyone stay on top of it? This session will give an in-depth look into the card dispute process from start to finish, with several examples of transactions and scenarios.

Vizo Financial’s Quarterly Tech-Talks

James Dellarosa, product strategy manager, Vizo Financial

June 20 at 1:00 p.m. ET

*Additional dates available

Each Tech-Talk will feature mini demos and showcase the FinTechs we think can bring big benefits to credit unions. In these quick 30-minute discussions, you’ll gain some understanding of the newest tools available to you, as well as what they could mean for the future of your institution, and get answers to your questions. This is your time to seek out the technology and innovation to help revolutionize your credit union. Let our Tech-Talk events be the start of your transformation journey!

Extreme Makeover: Work Edition - Refreshing Your Company Culture

Jeanne Heath, learning and engagement champion, Vizo Financial

June 27 at 2:00 p.m. ET

Why does every makeover have to be “extreme”? I guess the title “Modest Makeover” or “Subtle Shifts” just doesn’t bring in the same audience, huh? You don’t have to tear down the walls and scrap the entire building to create a fresh start, a new perspective and an environment that everyone is drawn to. “Modest Makeover” might not be a powerful title, but lasting, impactful change can come from small, meaningful choices. Join us to discuss simple changes you can make to strengthen your credit union team, reignite commitment to your purpose and make your employees WANT to come to work each day rather than feel that they HAVE come to work each day.

Over 55% of Vizo Financial employees prefer pancakes over waffles. Which team are you on?

Stay Connected!

Never miss an issue of Corporate Connection - sign up to get new issues sent directly to you!

Thank You New Users

Thank you to the credit unions and organizations that recently began using the following services:

Business Continuity Services

| West-Aircomm FCU | PA |

DefenseStorm

| Jackson River Community CU | VA |

Domestic Wires

| Paterson Police FCU | NJ |

Managed IT Services

| EP FCU | DC |

Penetration Testing

| Hershey FCU | PA |

| Lesco FCU | PA |

Securities Safekeeping

| Armco CU | PA |

| American Spirit FCU | DE |

SimpliCD

| Armco CU | PA |

| AFL-CIO Employees FCU | DC |

| American Spirit FCU | DE |

| Bellco FCU | PA |

| Chartway FCU | VA |

| Corner Post FCU | PA |

| MC FCU | PA |

| PAHO/WHO FCU | DC |

| Pinpoint FCU | PA |

| Pittsburgh City Hall Employees FCU | PA |

| Police FCU | MD |

| UFCW Community FCU | PA |

| Utilities Employees CU | PA |

| Wyrope Williamsport FCU | PA |

Social Engineering Testing

| American Pride CU | PA |

Student Loan Program

| United Community FCU | PA |

Vulnerability Scanning

| Hershey FCU | PA |

Zephyr

| Norther Star CU, Inc. | VA |

| Paterson Police FCU | NJ |

| Signal Financial FCU | MD |

Thank you to the credit unions and organizations that recently began using MY CU Services:

ACH Originations

| 3Hill CU | PA |

| CACL FCU | PA |

| North Carolina Community FCU | NC |

| North Jersey FCU | NJ |

| Signal Financial FCU | MD |

ATM Capture

| Destinations CU | MD |

Branch Capture

| Williamsport Teachers CU | PA |

ITM Capture

| SPC CU | SC |

Foreign Check Services

| CrossPoint FCU | CT |

International Wires

| Chartway FCU | VA |

Mobile Capture

| Lesco FCU | PA |

| Valley 1st Community FCU | PA |

OFAC

| Penn East FCU | PA |

Share Drafts

| DC Teachers FCU | DC |